Just Tech Me At

Akamai Technologies, Inc.

Symbol: AKAM

2022

Financial Profile of

Akamai

(March 25, 2023)

Summary

Akamai Technologies, Inc. provides cloud services for securing, delivering, and computing content, applications, and software over the internet in the United States and internationally. The company offers cloud solutions to keep infrastructure, websites, applications, application programming interfaces, and users safe from various cyberattacks and online threats while enhancing performance. It also provides web and mobile performance solutions to enable dynamic websites and applications; media delivery solutions, including video streaming and video player services, game and software delivery, broadcast operations, authoritative domain name system, resolution, and data and analytics; and cloud computing services, such as compute, storage, networking, database, and container management services to build, deploy, and secure applications and workloads. In addition, the company offers carrier offerings, including cybersecurity protection, parental controls, DNS infrastructure and content delivery solutions; and an array of service and support to assist customers with integrating, configuring, optimizing, and managing its offerings. It sells its solutions through direct sales and service organizations, as well as through various channel partners. The company was incorporated in 1998 and is headquartered in Cambridge, Massachusetts.

Sector: Technology

Industry: Software-Infrastructure

Full-Time Employees: 9800

Contact

145 Broadway

Cambridge, MA 02142

United States

617 444 3000

website- https://www.akamai.com

Quarterly

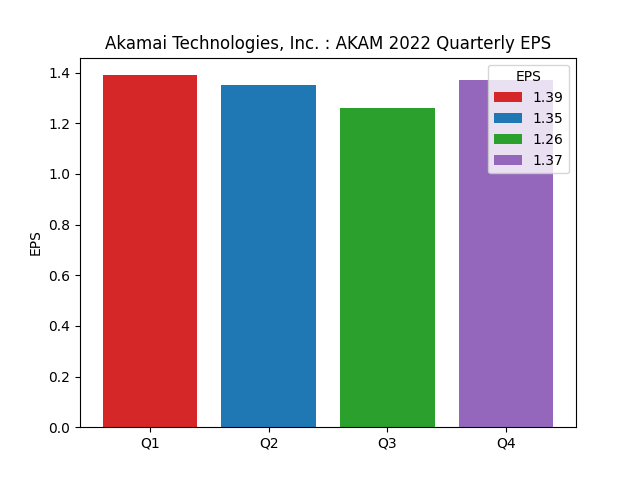

Earning Per Share

| Period | Earnings Per Share |

|---|---|

| 1Q2022 | 1.39 |

| 2Q2022 | 1.35 |

| 3Q2022 | 1.26 |

| 4Q2022 | 1.37 |

Quarterly

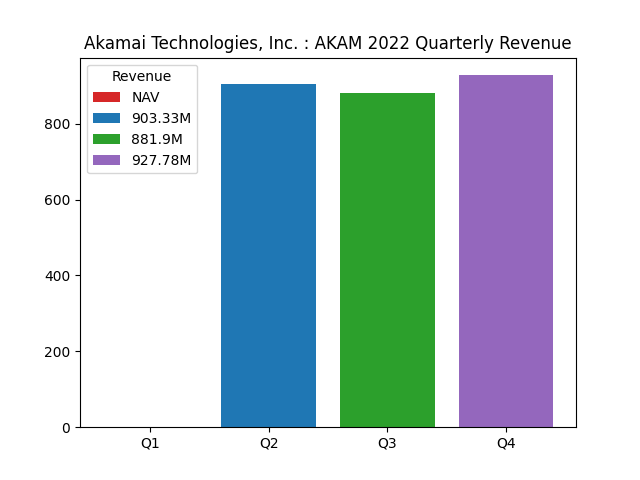

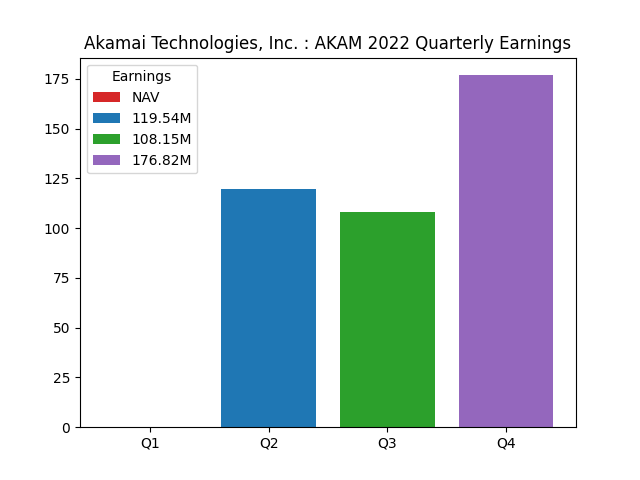

Revenue and Earning

| Period | |||

|---|---|---|---|

| 1Q2022 | |||

| revenue | NAV | ||

| earnings | NAV | ||

| 2Q2022 | |||

| revenue | 903.33M | ||

| earnings | 119.54M | ||

| 3Q2022 | |||

| revenue | 881.9M | ||

| earnings | 108.15M | ||

| 4Q2022 | |||

| revenue | 927.78M | ||

| earnings | 176.82M |

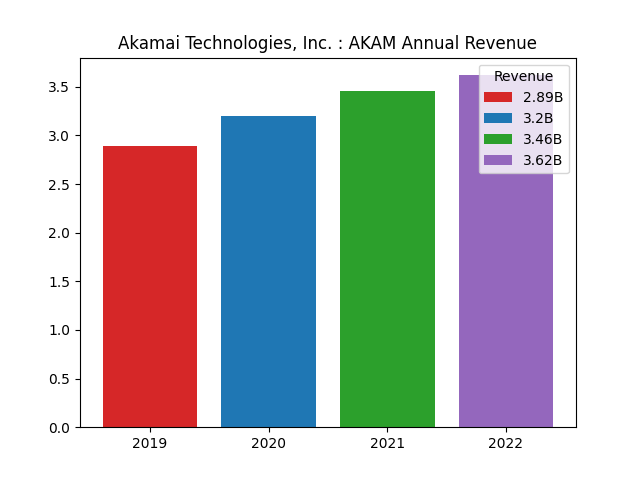

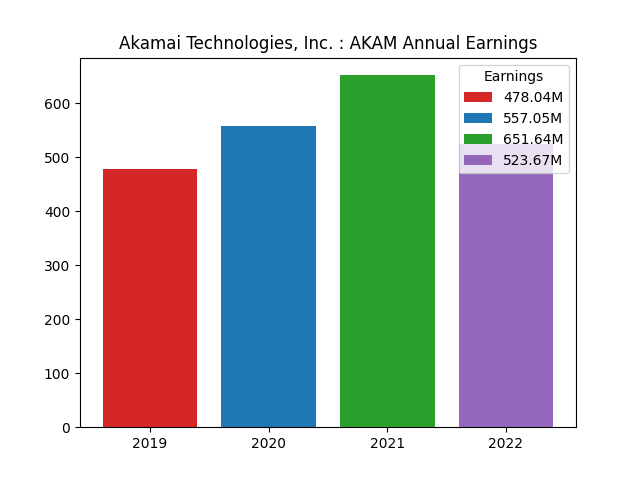

Annual

Revenue and Earning

| Period | |||

|---|---|---|---|

| 2019 | |||

| revenue | 2.89B | ||

| earnings | 478.04M | ||

| 2020 | |||

| revenue | 3.2B | ||

| earnings | 557.05M | ||

| 2021 | |||

| revenue | 3.46B | ||

| earnings | 651.64M | ||

| 2022 | |||

| revenue | 3.62B | ||

| earnings | 523.67M |

Financial Analysis Data

| Assessment | Value |

|---|---|

| ebitda margins | 31.68% |

| profit margins | 14.48% |

| gross margins | 61.87% |

| operating cash flow | 1.27B |

| revenue growth | 2.50% |

| operating margins | 19.88% |

| ebitda | 1.15B |

| gross profits | 2.24B |

| free cash flow | 815.79M |

| earnings growth | 15.20% |

| current ratio | 2.40 |

| return on assets | 5.47% |

| debt to equity | 72.81 |

| return on equity | 11.78% |

| total cash | 1.11B |

| total debt | 3.17B |

| total revenue | 3.62B |

| total cash per share | 7.07 |

| revenue per share | 22.73 |

| quick ratio | 2.18 |

Data Source: RapidAPI Yahoo Finance

Charts: Python generated charts provided courtesy of JustTechMeAt.